Deliver seamless customer experiences by automating retail banking operations, while reducing OpEx and boosting revenue with the world’s leading conversational AI platform.

The Nextgen TX Automation Platform

Virtual personal banking agents for your customers

What can chatbots do for the Banking industry?

Drive Awareness and Generate Leads

Generate qualified leads with AI-powered digital advertising and drive conversations at scale on any channel of your choice with a chatbot.

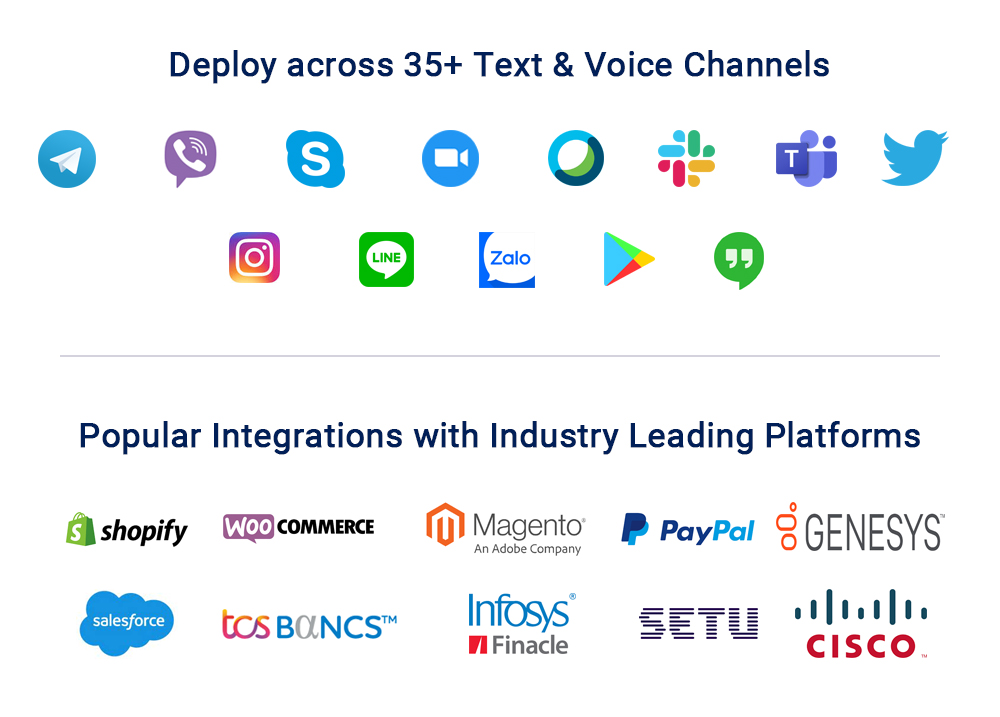

Manage Multiple Channels through a Unified Agent Assist

Generate qualified leads with AI-powered digital advertising and drive conversations at scale on any channel of your choice with a chatbot.

Stay on Top of Customers’ Minds

The chatbot follows up with clients that are interested in the recommendations with push notifications at the right time to initiate next steps and educate on promotions or schemes.

Easily Onboard Customers & Offer Effortless Registrations

The chatbot can effortlessly handle one of the many repetitive tasks of onboarding the clients with detailed guidance on making transactions. It also allows customers to register for multiple services or book appointments through a smooth conversation flow, leading to higher conversions from campaigns.

Transactions & Personal Banking

Customers can transact through the chatbot and avail multiple services like getting account information, managing cards, availing offers or applying for new financial products by.

On-demand Customer Support & Complaints Handling

Customers can query the chatbot with all-things finance or banking and the chatbot will answer in real-time. They can also lodge a complaint and chat with a live agent, if needed.

Benefits of our Banking Chatbots

Happy Employees = Happier Customers

The chatbot helps agents with proactive services, smart analytics, intelligent upselling and cross selling and contextual information so they can help customers better, eliminating errors or wait times which improves CSAT and ESAT.

Humanistic conversations in over 100 languages

Our chatbots deliver accurate responses and hold natural conversations in 100+ languages in addition to features like intent identification and sentiment analysis.

Speedy deployments

Speedy SLAs, domain specific pre-trained modules for bots and a flexible platform that fits with your system, seemlessly allows you to go to market faster than any legacy banking system.

Bot orchestration to manage various verticals

Bot orchestration helps an employee retrieve information when a company has several departments where data is isolated. Each department has a child bot that reports to the master bot which in turn helps customers/employees with the right information.